Traditional vs Roth - Which One Do You Pick?

Choosing between Traditional and Roth isn’t as straight forward as closing your eyes and picking one. There is a good rule of thumb you can follow that helps you decide which tax treatment to choose. Of course, I recommend talking to a financial planner for customized advice for your personal situation. Rules of thumbs are great for generic advice, but everyone has a unique situation. These hold true for a 401(k), 403(b) & IRA.

With an IRA, you can choose between a traditional IRA or Roth IRA.

With a 401(k)/403(b) you can choose traditional or, most companies/organizations now, offer the Roth version too.

What is the “Traditional” Tax Treatment?

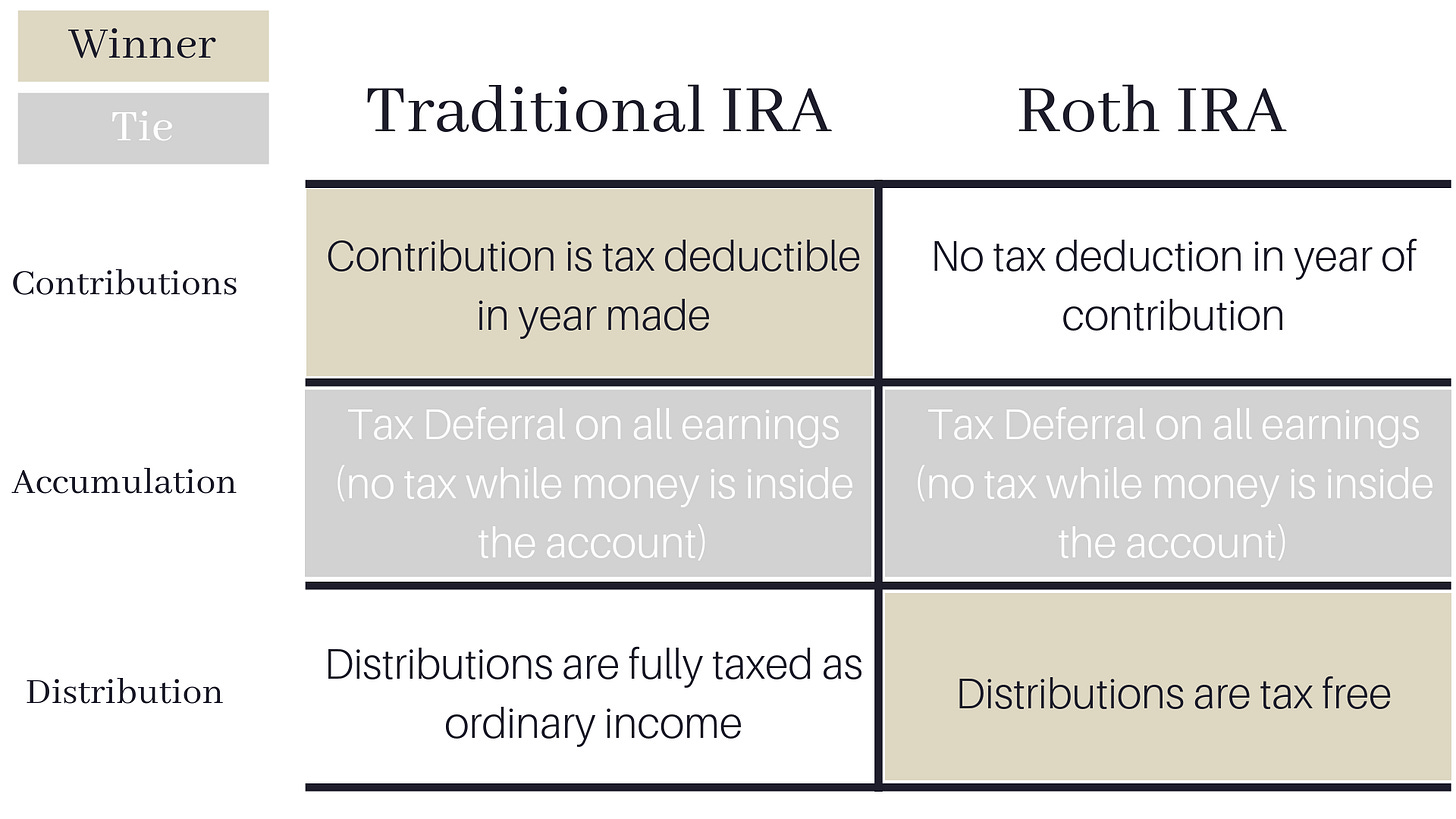

When it comes to a traditional IRA, 401(k) or 403(b), this means the tax treatment is: money going in is tax deferred → money grows tax deferred → you pay taxes when you withdraw on both contributions + earnings.

Essentially you get to defer the taxes until retirement.

What is the “Roth” Tax Treatment?

When it comes to a Roth IRA, 401(k) or 403(b), this means the tax treatment is: money going in is after tax money → money grows tax free → you don’t pay taxes when you withdraw contributions or earnings.

Essentially you pay taxes now to never pay taxes again for this retirement account.

Here is a great visual of the difference between the Traditional vs Roth tax treatment:

How To Decide On Traditional vs Roth?

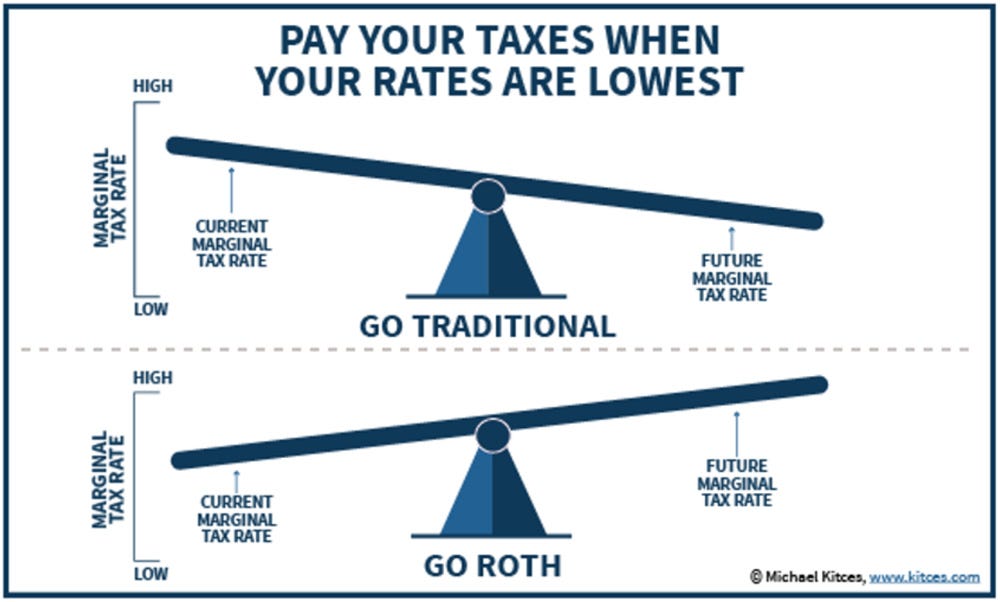

An easy question to ask is “do you want to pay taxes now or later?”

If you are currently in a low tax bracket, it probably makes sense to do Roth.

If you are currently in a high tax bracket, it probably makes sense to do Traditional.

Most of the time, this are the tax brackets that make sense to choose Roth or Traditional:

10-12% bracket: Roth

22-24% bracket: Choose either

32% +: Traditional

At the end of the day, getting any money invested is better than not investing at all. However, these tax decisions may seem small today, but in 20, 30, 40+ years, they can create major differences. That is why it is important to constantly be checking your tax situation to optimize your taxes & not overpay your share of taxes in your lifetime.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.