Joint Investment Accounts - Everything You Need To Know

A Joint Tenant with Rights of Survivorship (you might see this shown as “JTWROS”) investment account is a type of account owned by two or more individuals, where each person has equal rights to the assets in the account. The key feature of a JTWROS account is the right of survivorship. This means that when one account holder passes away, the remaining account holders automatically inherit the deceased person's share of the assets, without the need for probate (when it comes to estate planning, this is important).

Let’s say you are about to open a JTWROS account with your spouse, here are some important things you should know:

1. Ownership

All owners (also called "joint tenants") have equal ownership of the assets in the account. This means that each spouse has the right to withdraw or transfer funds. This also means one spouse can transfer all the funds without the other spouse’s consent.

2. Right of Survivorship Feature

The most significant feature of a JTWROS account is the right of survivorship. When one person dies, their share of the account passes automatically to their spouse.

This transfer happens without going through probate. However, this also means the deceased person's will or trust will not control the distribution of their portion of the account since it goes directly to the surviving spouse.

3. Types of Accounts You Can JTWROS

Bank Accounts: Joint accounts at banks often use JTWROS, however you may only see it say “Joint Account”.

A benefit of joint accounts at the bank is that FDIC insurance covers $250,000 per co-owner, so the total coverage for the account is $500,000.

Investment Accounts: Investment accounts, such as brokerage accounts, can also be set up as JTWROS. For example, this is what you would select if you were wanting to open a joint account on Vanguard:

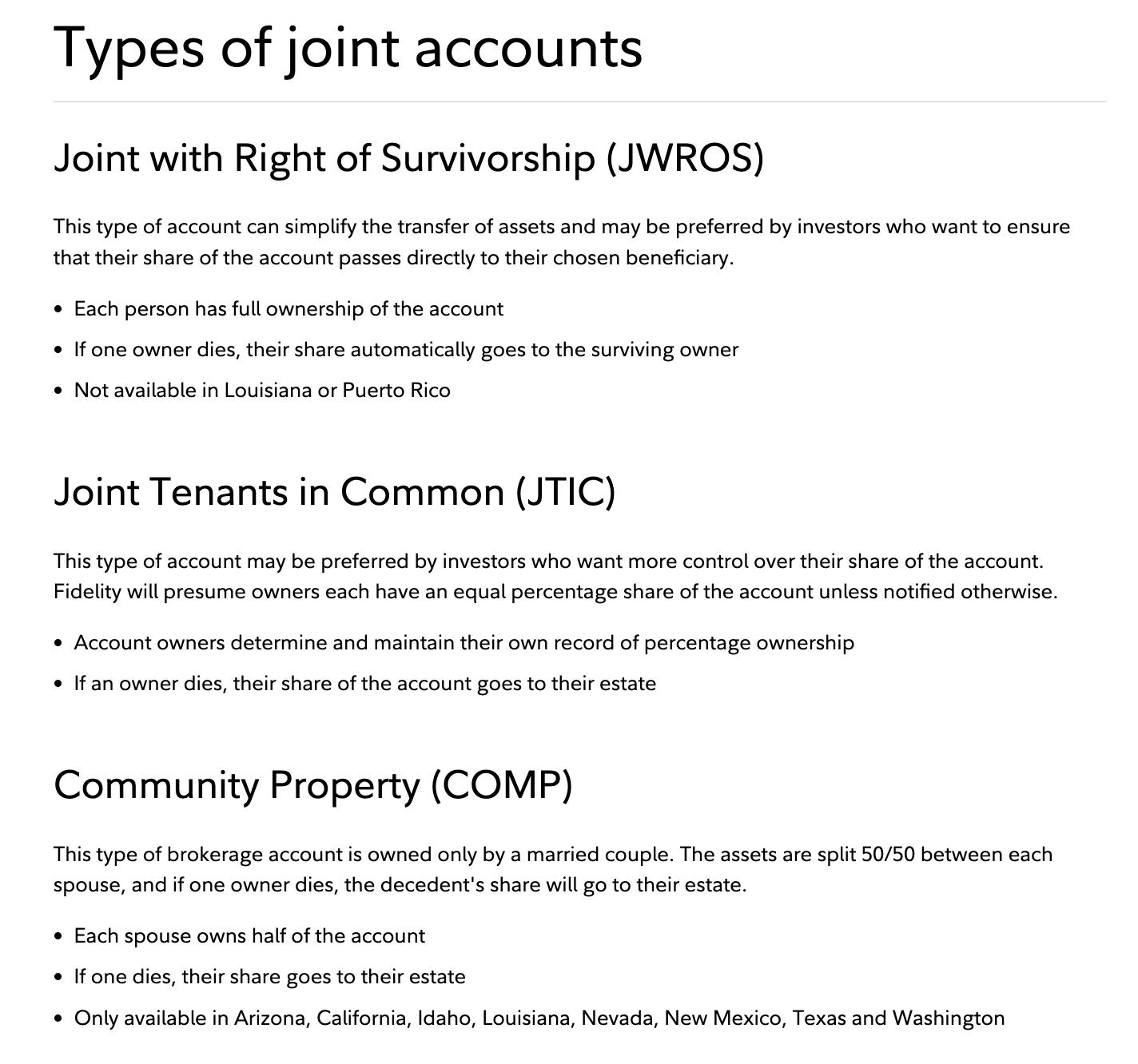

When it comes time to merge your investment account with your spouse, the JTWROS option is most common. However, other types of joint accounts include Joint Tenants in Common & Community Property. Here is an explanation from Fidelity of each joint account type:

4. Potential Risks

I always like to share the pros & cons of everything. For joint investment accounts, there are some potential risks to think about.

First, if both spouses have different investing goals, then there couple a disagreement on how that money should be invested. One person may be more conservative than the other & they cannot agree on what stocks/ETFs to buy (hint: this could be a good reason to meet with a financial planner).

Secondly, all account owners are held liable for the actions of the other account owners. If one of the owners of a joint brokerage account encounters trouble with debts and creditors, the joint account could be seized if the creditors come after the assets of one of the individuals. That puts the other individual in financial jeopardy.

Thirdly, in the case of a divorce or you split with your spouse then you run the risk of one party selling off assets in the account.

All in all, joint accounts can be a great financial tool for couples to use to achieve their financial goals. Whether that is with their bank account and/or investment account, having a joint account allows for shared goals, financial honesty & working towards a common goal, together.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to hire a financial planner, read this post: Hiring A Financial Planner As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.