How Your Taxes Change As A Married Couple

To illustrate how your taxes change when you go from a single filer to married filing jointly, we need to start with understanding how taxes work in the USA. The US has what is called a progressive tax system. This means as you make more money & fill up brackets of taxes, those dollars get progressively taxed more.

The US Tax System

There are multiple statuses to file your taxes, which all bring different tax rates & nuances. For sake of explanation, I am going to just share information on single filing and married filing jointly.

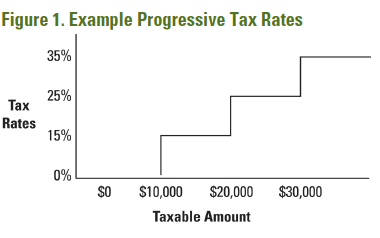

Like stated above, US taxes are progressive. Below is an example of how this looks visually:

While those numbers above are just for example & are not the actual current tax rates, this image does a great job of showing the progression of taxes as you make more money. This does not mean if you make more you end up with less overall money in your pocket, because taxes are progressive. Let me explain the image this way:

The dollars earned from $0-$10,000 are taxed at 0%

The next dollars earned from $10,001-$20,000 are taxed at 15%

The next dollars earned from $20,001-$30,000 are taxed at 25%

The next dollars earned over $30,000 are taxed at 35%

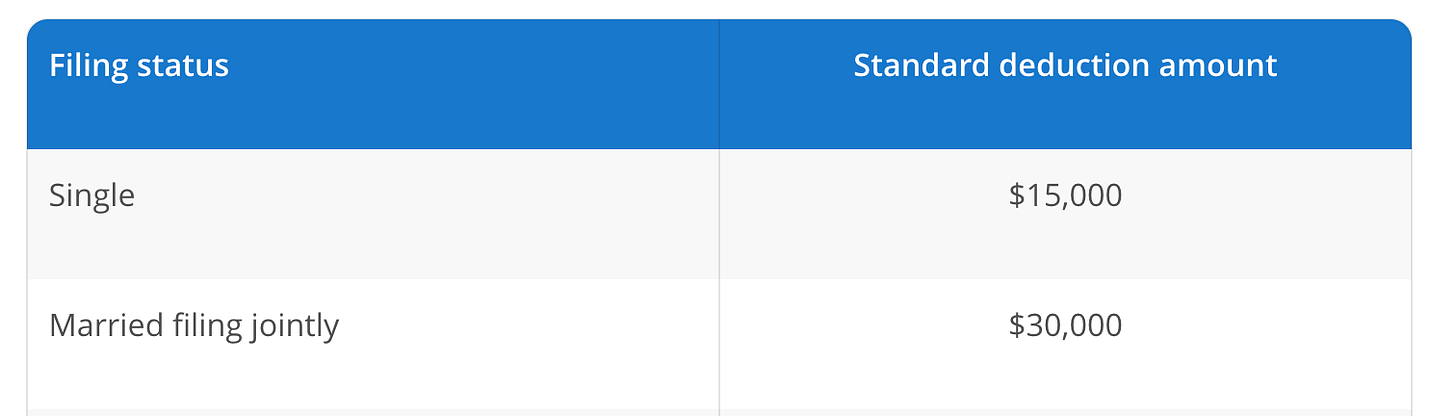

As your dollars earned fill up a tax bracket bucket, that is the rate those dollars are taxed. Once you “fill up” a tax bucket and move to the next one, only the future dollars earned are taxed at the new tax rate, not all your dollars earned. Let’s say someone earned $32,000 with the tax rates above. Not all $32,000 is taxed at 35%. Rather, we calculate the tax brackets as the income comes in & fills up each bracket.

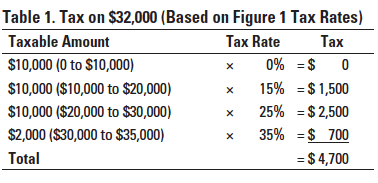

So on $32,000 of income, this person paid $4,700 in taxes. We would say they are in the "35% tax bracket” however in reality, if we took $4,700/$32,000 then they had an average tax rate of only 14.69%. This is a very simplified explanation of taxes in the US, but I hope it gives you some context on the US tax system.

Note: Tax rates as of the time of writing, March 5, 2024, will be used below. This can & probably will change in the future, so if you are looking at this in 2027 or 2035 then make sure you search current year tax rates.

Single Filer Tax Rates

One way that people can file taxes is as a single filer. The tax rates for a single filer are below:

Married Filing Jointly

The tax code says you can file as married filing jointly as long as you were married in the tax year. For example, a couple who gets married in January 2025 can file as married filing jointly for 2025 tax year. A couple who gets married in December 2025 can also file as married filing jointly for 2025 tax year.

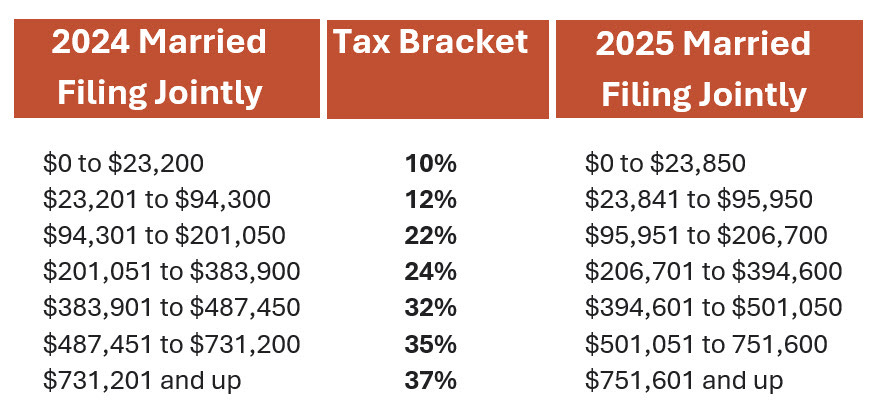

If we compare the MFJ (married filing jointly) tax rates to a single filer, the tax rates go higher relative to taxable income. While you may have two incomes now, the tax rate is better, all else being equal.

For example, a single filers 22% bracket goes to the $103,350 of taxable income, then they flow into the 24% bracket. A MFJ filers 22% bracket goes all the way to $206,700 of taxable income before the flow into the 24% bracket.

What makes up taxable income & taxes in general is for a whole different blog, but it is good to have a base level understanding of the differences between single filer tax tables and MFJ tax tables.

Note: If you plan to move from a single filer to MFJ, make sure to let your payroll team know you want to change your paycheck status to MFJ. This will change your withholdings due to change in filing status. However, it is a good idea to talk with a financial planner to see if you need to withhold extra due to total household income sources.

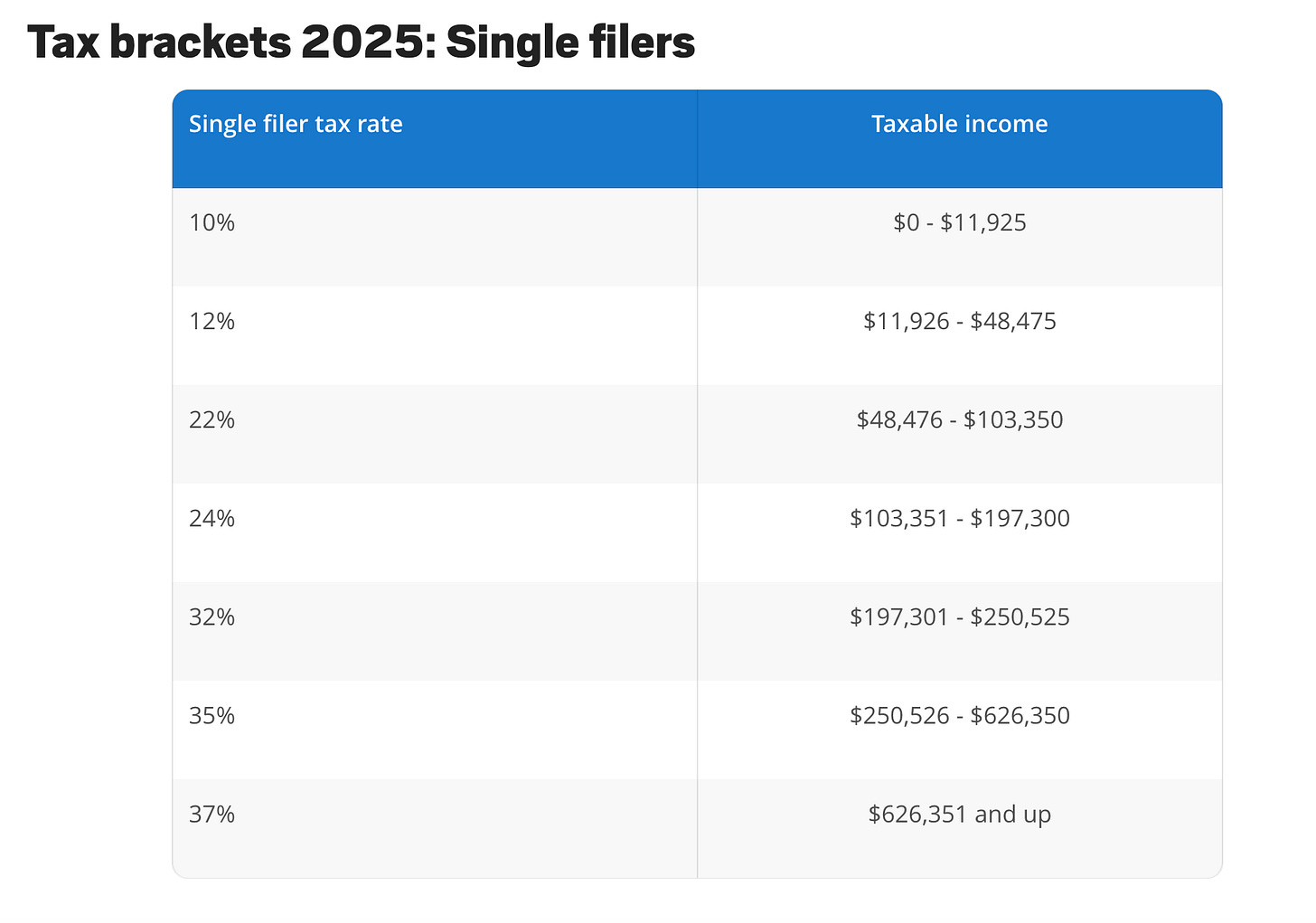

Standard Deductions

The US tax code allows for deductions. There is the standard deduction & itemized deduction. With the current tax code, most people will use the standard deduction. This is a set amount (it usually increases each year) that tax payers can subtract from their adjusted gross income.

Note: These change if you are blind and/or 65 & older.

Itemized Deductions

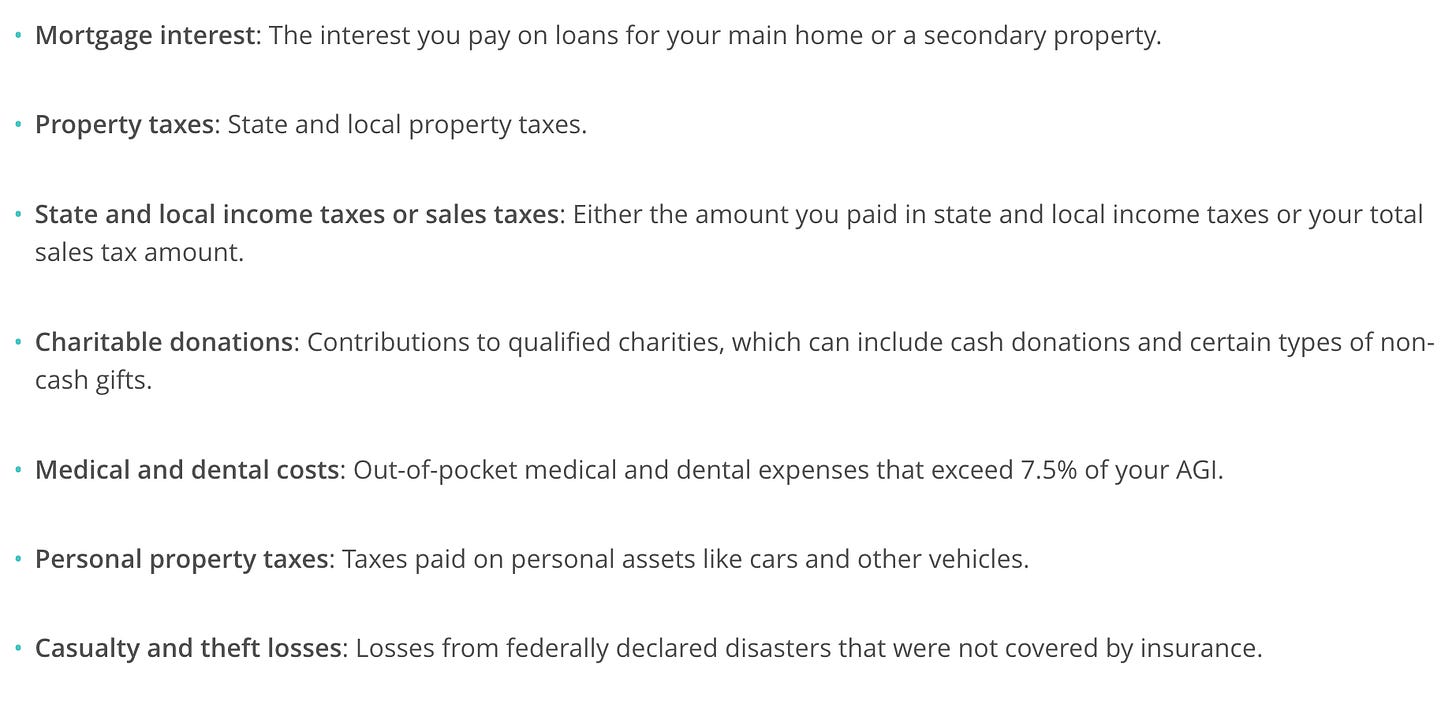

If you calculate your itemized deduction and it is greater than your standard deduction amount, then you can choose to take the itemized deduction. This usually applies to higher income tax payers, although it is possible for anyone to itemize their deductions. Like stated above, under current tax law, most people will take the standard deduction. Things that qualify for itemized deduction are:

Capital gains tax

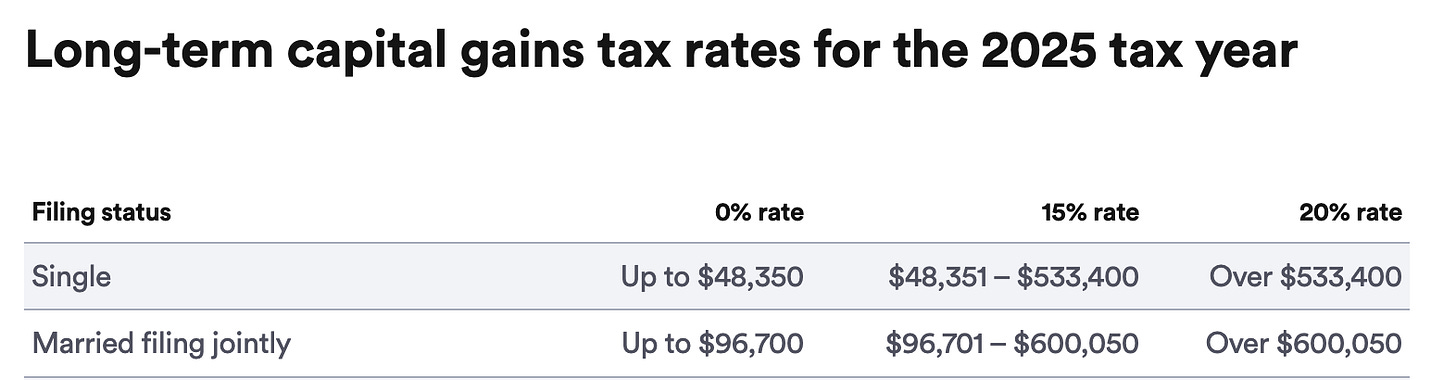

Another common tax you may encounter is capital gains tax. There are different tax rates for single filers vs married filing jointly. The capital gains tax is important when thinking about your tax planning aspect of your finances.

Will tax rates change?

Each year, the dollar amounts that fall into each tax bucket usually go up. For example, here is the change from 2024 tax year to 2025 tax year for MFJ.

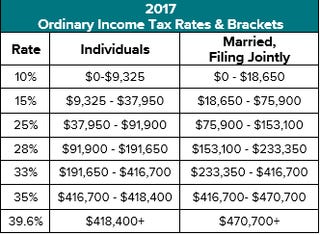

Current tax rates are set to sunset in end of 2025. This means we will revert back to the 2017 tax code, which is higher tax rates in terms of brackets.

In 2025, the tax rates are 10% - 12% - 22% - 24% - 32% - 35% - 37%

In 2017, the tax rates were 10% - 15% - 25% - 28 % - 33% - 35% - 39.6%

You could say tax rates are “on sale” currently.

Lastly, many speculate that the current tax rates will be extended under the current administration. However, that has not happened yet at the time of writing this.

Taxes can be very confusing and daunting, but having a basic understanding of US tax code is a great knowledge to have!

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.