Health Savings Account (HSA) For Newly Married Couples - What You Need To Know

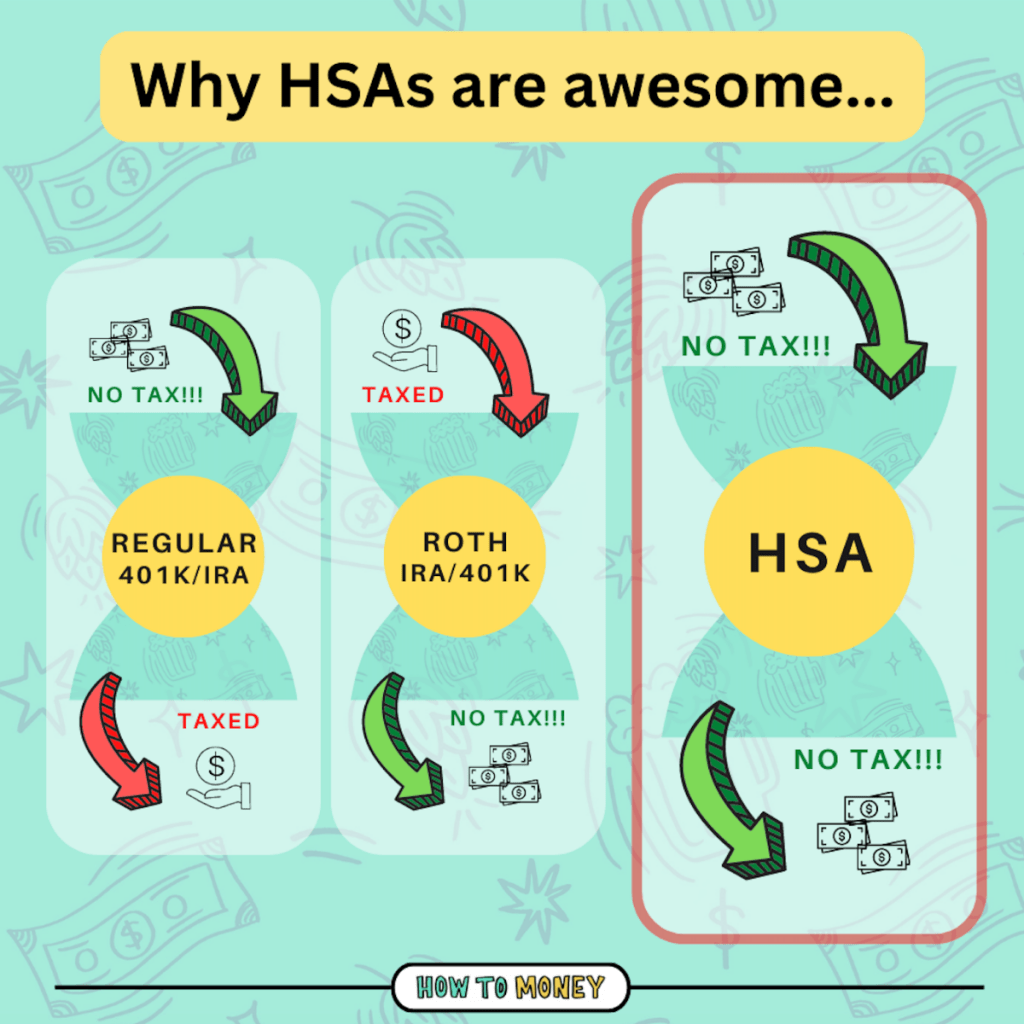

The Health Savings Account (also known as the HSA) is an incredible financial tool that allows you to get some pretty awesome tax benefits to save for healthcare. If you are single or newly married, if eligible, utilizing an HSA can be a smart tool in your financial belt to use.

What is an HSA?

An HSA is a type of account designed to help people save money for medical expenses. It offers several tax advantages and is typically paired with a high-deductible health plan (HDHP). Here's how it works:

Tax Benefits

Contributions: Money you put into an HSA is tax-deductible, meaning it reduces your taxable income.

Earnings: The money in your HSA grows tax-free.

Withdrawals: When you withdraw money for qualified medical expenses, the money is tax-free.

There is a long list of things considered to be qualified medical expenses, so here is a link to them: https://hsabank.com/Learning-Center/IRS-qualified-medical-expenses

You can pay for a spouses medical expenses from your HSA, even if your spouse doesn’t have an HSA or a HDHP. This is true even if your spouse has individual-only coverage under a traditional medical plan.

You can also use your HSA funds to pay for the medical expenses of any dependent children claimed on your income tax return.

Eligibility

To open an HSA, you need to be enrolled in a high-deductible health plan (HDHP), and you can't be covered by any other health insurance, including Medicare. You also cannot be claimed as a dependent on someone else’s tax return.

Contribution Limits

For 2025, the contribution limit for individuals is $4,300 and for families, it’s $8,550.

Each individual spouse can have an HSA if both are covered under a HDHP. There is no such thing as a joint HSA account. However, if both spouses have an HSA open, the limit is a combined $8,550.

People age 55 or older can contribute an additional $1,000 as a "catch-up" contribution.

Investing Feature

HSA account holders can have the option to invest a portion (or all) of contributed funds. You can typically invest a portion (or all) of your HSA balance in mutual funds, stocks, and bonds.

Portability

Unlike a Flexible Spending Account (FSA), the funds in an HSA roll over from year to year. The account is yours even if you change jobs or insurance plans.

Retirement Savings

If you don't use the funds for medical expenses, you can use the money for other purposes once you turn 65, although non-medical withdrawals will be taxed as income (similar to a traditional IRA).

You can also use the funds to pay for Medicare premiums, which are considered qualified expenses. In 2025, the standard monthly premium for Medicare Part B is $185 per month per person.

Future Use

An interesting feature of the HSA is you can use previous years health expenses to reimburse you in the future, tax free. For example, if you paid out of pocket for a health related expense in 2025, kept the receipt, then in 2035 you could take the withdraw to reimburse yourself, tax free, from your HSA. Even though the expense occurred in 2025, you can take the money out in 2035 from the HSA. The important step here is keeping your receipts for your records.

HSAs are an excellent way to save for future medical expenses while taking advantage of the triple tax benefits they offer. If you have a HDHP with an HSA, then it is a good idea to weigh the pros and cons of going that route. A flat fee, fiduciary financial planner can help you make these decisions.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.